by Jeff Pittman | Mar 31, 2015 | Buyers

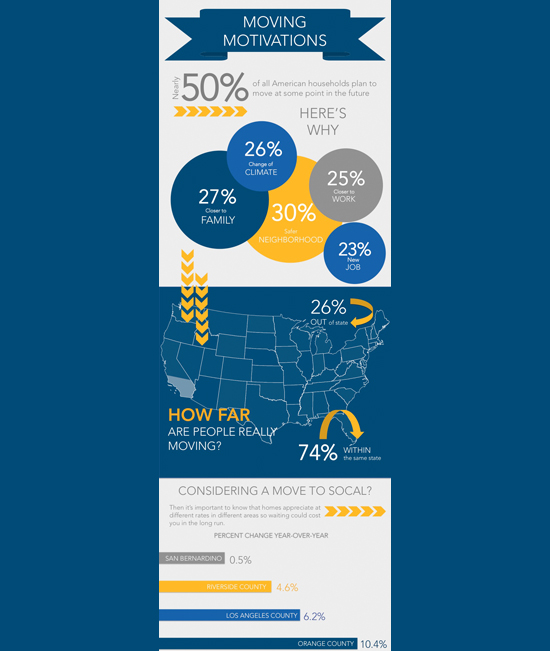

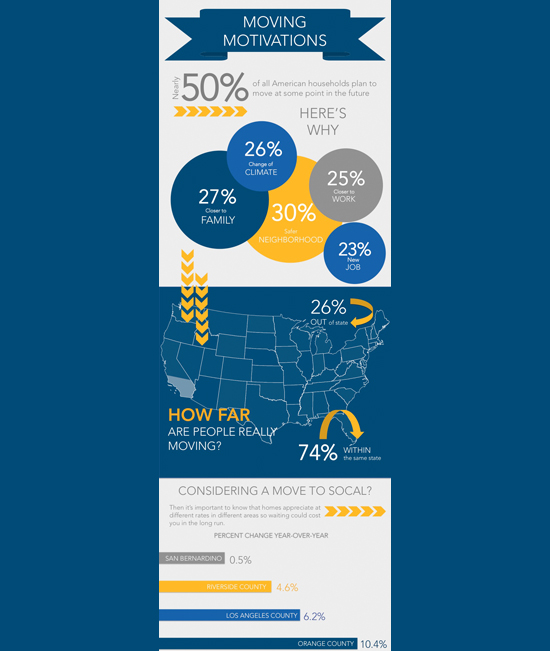

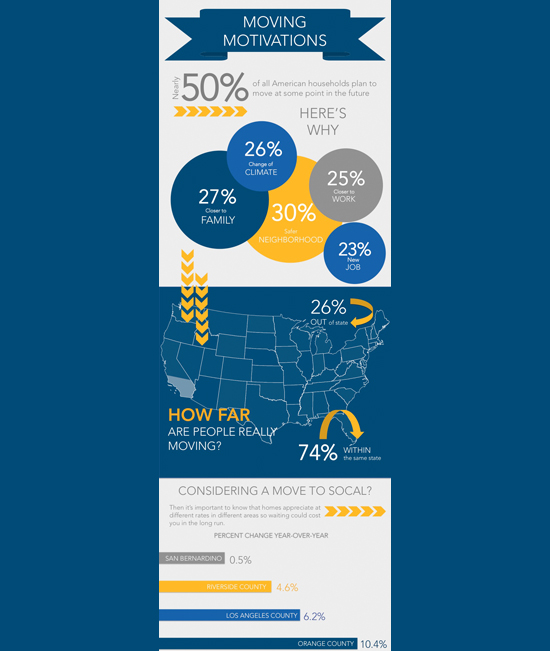

What’s Motivating America’s Movers? Three out of every four movers reported that their move was all about location, location, location. In fact, 47% of participants surveyed agreed that the location where they live is more important than the home itself. If the gorgeous SoCal climate and safe suburban neighborhoods are calling to you, give us a call at 714.785.4434. Via First Team Real Estate. Thank you for reading. I hope you found this information useful. Jeff Pittman, Realtor in Ladera Ranch – Orange County,...

by Jeff Pittman | Mar 10, 2015 | Buyers

When you enter the real estate game, it’s important to have a plan. If you want to find the right home, at the right price and avoid the pitfalls of real estate newbies, then take a look at these tactics and strategies to keep your mind focused during your search.So get your game face on and let’s start planning! Here are 10 tactics for winning a home buyer game plan: 1. Learn about loans Mortgage loans are one of the most complicated pieces of the home buying puzzle – and they have the biggest effect on how much you pay for your home. However, according to recent data from the California Association of Realtors, 54% of first-time buyers didn’t fully understand the different loan options available and 43% said they did not completely understand the process. Take your time and immerse yourself in the world of Mortgage loans. 2. Tour houses in real life – not just online Nearly every homebuyer starts their search online but once you get serious, get out there and start viewing homes. Open houses are your friend. You can read square footage counts but until you see it for yourself you won’t know if it’ll work for you. Check out open houses in Southern California this weekend and take action on your homebuyer game plan. 3. Never forget to negotiate The real estate market is about to heat up for spring and summer, which means more competition. The best way to combat that competition is with a great strategy. That being said, it’s important to put an offer on a home that is competitive with other...

by Jeff Pittman | Feb 19, 2015 | Buyers

As a first-time home buyer, you may be concerned about doing comparison shopping when it comes to getting a loan. A mortgage may be a commitment that you are tied to for decades or until you sell your home, and you certainly want to ensure that you make the best decision possible when applying for your loan. Here are 4 useful online resources when shopping for your home loan: Online Budgeting Tools and Apps Before you go through the effort to start shopping for a home loan and comparing interest rates, you may first want to review your personal budget. You can use great resources online like this general budget calculator from YouCanDealWithIt.com.Each tool and app may offer different benefits, so you may consider putting several to work for you as you prepare a budget. Once you know what your budget for the near future looks like, you’ll be much more prepared to meet with a financial representative, and stay within budget when house hunting. Home Affordability Calculators After you have a functional budget prepared, your next task will be to determine the size of home that you can afford to purchase. Keep in mind that some lenders may tell you that you can afford to purchase a much more costly home than what may be manageable for your budget. Home affordability calculators are available through many bank and lender websites, as well as through Bankrate.com and others around the web. Mortgage Loan Payment Calculators Many who are shopping for a home loan may use a home affordability calculator in conjunction with a mortgage loan payment calculator. You can...

by Jeff Pittman | Jan 15, 2015 | Buyers

When to buy a home depends primarily on an individual buyer’s timeline. When the down payment is saved, when you get a new job, when that perfect house comes onto the market, etc. However there are times when buyers have other advantages and reasons to get a jump on the market. February is not only the month of Valentines love, it’s a great month to fall in love with a new home. Here are reasons to buy a home in February: 1. You’re out of the holiday fog The holidays are a crazy time. Once everyone’s done with Christmas and the New Year, it’s back to business. That means more homes on the market (more choices for you) and sellers are more realistic and discerning with prices. It’s not uncommon for the New Year to light of fire under some real estate butts and get sellers motivated. In fact, inventory historically spikes up in February because sellers who have been holding out the have a comfortable holiday at home are now ready to get on the market. With the right goals and mindset, nothing can stop you from getting into a perfect home this year. 2. Get a jump on the spring madness Spring is the busiest time in real estate. Buyers and sellers alike want to get their home lives sorted out over the summer so that come fall, their families are settled in. Take a look at the chart below and you’ll see the huge spike in homes for sale and a steady increase in sold properties in June and July. Now take a closer look at the chart...

by Jeff Pittman | Jan 8, 2015 | Buyers

Without a doubt the primary benefit of installing a good home security system in your home is to decrease the likelihood of getting burglarized. In fact, it’s the main reason why people install a system to begin with. But there are many other unexpected benefits of having a home security system that you may or may not be aware of. Here are a few things you never realized a home security system could do. 1. Get You Cheaper Home Insurance Incorporating a new home security system that also has off-site monitoring can significantly lower your premiums overall. In fact, you may be pleasantly surprised at just how much lower they’ll be, although the reduction amount varies based on the particular insurance company. 2. Prevent Water Damage If your water heater breaks or a faucet starts leaking without you noticing, the damage that results can be overwhelming as well as costly. Besides ruining the walls, flooring, and furniture, it can destroy your irreplaceable valuables as well. However, this bad scenario can easily be prevented by installing a wireless home security system. Through companies like Arpel Security Systems, you can add a floor sensor alarm to your security system that will immediately notify you via your smartphone if a leak occurs or water starts overflowing somewhere in your home. 3. Allow You To Monitor Your Children We’re all concerned about the general welfare and safety of your our children when you’re not at home, but did you know a wireless alarm system can ease those worries? With these systems, you can send an email and/or text message along with an attached...

by Jeff Pittman | Dec 26, 2014 | Buyers

Newly constructed homes are very popular with a large segment of buyers. There are good reasons for it too – other than that new home smell of course. With pros and cons for both new and resale homes, you can’t go wrong but here are 4 reasons why buying new can cut homebuyer costs. 1. Peace of mind Like everybody else that completes the purchase of a home, things are going to be a little bit tight for a while. You don’t need any new headaches. Like a new car as opposed to a used car, the likelihood of problems arising is diminished in buying new. Nothing in the home has ever been used before. There’s no 20-year-old HVAC system to worry about or faulty electrical wiring. You will have peace of mind knowing that you won’t likely have any major repairs to worry about. 2. Energy savings While older homes have their charm, most are not energy-efficient and be very costly to keep it warm of cool. Newly built homes are much more energy conscious than those of decades ago. That new HVAC system has never been used and it’s incredibly more efficient than the clunker in an older home. The new kitchen appliances and water heater will also be of higher efficiency. You’re saving big on energy costs with new construction. KB Builder has recently built several new home developments in Southern California. Their solar power energy system and WaterSense appliances on average save homeowners $1,000 on their energy bills per year. 3. No Repairs In a newly built home, there aren’t any drippy faucets, cracked windows, holes in...